“This article originally appeared on www.stout.com.”

Physician compensation arrangements have changed under constant and fluctuating pressure from the dynamism of the healthcare landscape.

Physician compensation arrangements have evolved during the last two-plus decades. Not only have they changed, but they’ve done so under constant and fluctuating pressure brought on by the dynamism of the healthcare landscape.

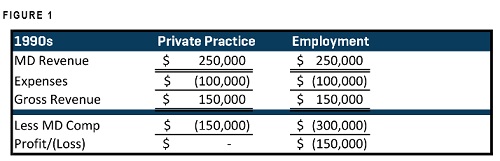

In the 1990s, as hospitals gobbled up physician practices with an eye toward managed care, the hospitals generally offered robust salary guarantees. As might be expected, broadly speaking, the health systems began bleeding money from their employed ventures. Health system employment transitioned many of the headaches of private practice management from the physicians to the hospitals and, in many cases, offered providers rich deals with limited downside. (Of course, trading day-to-day management of a practice for employment is a give/get proposition.)

Where once physicians managed their practices to ensure “below the line” profitability (which ostensibly passed through to the shareholders), employment models mitigated the need for physicians to run their practices in a cost-effective manner. Concurrently, these employment models removed worries about things, such as HIPAA, information technology (IT), staffing, medical malpractice costs, rent expense, and revenue cycle (RC) management. Those management headaches were transferred to the hospitals. In many cases, provider production was static or declined theoretically because the physicians were guaranteed incomes regardless of cost drivers.

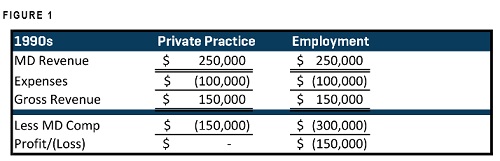

In the examples below we take a high-level look at compensation shifts for the last two decades.

Figure 1.

1990s Physician Compensation

First, the caveat to this article is that it is, by design, overly simplistic (but directionally accurate). It is built to use bite-sized graphics to display mathematical machinations and convey those to the reader. Actual compensation plan design is complicated with many moving parts.

Preamble aside, as evidenced in Figure 1, let’s assume that Dr. X’s private practice generated $250,000 in revenue (cash accounting). Expenses for the same period were $100,000. That left $150,000 in gross revenue. In the private practice setting, money not spent running the practice drops to the bottom line and the shareholders. In this case, Dr. X, as noted in the Private Practice column above, had gross revenues of $150,000, so he paid himself a salary of $150,000. (If he had shaved $50,000 in expenses, he otherwise may have paid himself an additional $50,000 or a salary of $200,000.)

Now let's say that Dr. X has grown disenchanted with day-to-day management of running a medical practice. He simply wants to practice medicine. Fast forward to when Dr. X becomes employed by Hospital Y. We’ll suggest that Dr. X is an internal medicine provider and Hospital Y is growing its internal medicine base. The hospital guarantees that Dr. X will make $300,000 per year. However, as indicated under the Employment column in Figure 1, Dr. X generates no more revenue and his expenses are static. Removing his guaranteed compensation leaves the system $150,000 in the red for Dr. X (otherwise known as “subsidizing” the physician).

After rivers of red ink, in the late '90s, many systems divested medical clinics, creating a period of detente. However, in the 2000s, the acquisition game began anew. Medicare’s reimbursement cuts to many specialties on in-office procedures (such as imaging) essentially flipped the economics of the medical practices. For those practices that were greatly impacted (with high Medicare populations) and that may have been poorly managed (e.g. inflated expenses), the loss of revenue shrinking the delta of profitability drove many providers to the relative protection of the health systems.

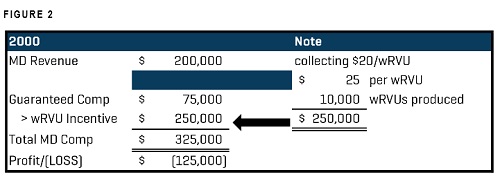

2000s and the wRVU model

In the 2000s, systems that acquired physicians took a decidedly different tack toward the compensation conundrum. In lieu of a big guarantee, health systems began to reward physicians for the work performed. While not perfect, the work relative value unit (wRVU) compensation models provided a means of objectively rewarding providers for “working.” That simply translated into more work, more pay; less work, less pay. This offered systems some downside protection for reduced physician productivity. (Concomitant with the wRVU productivity model are inherent downsides.)

Many newly crafted compensation plans, whether stepped/tiered threshold models or cash/wRVU payments, were deployed.

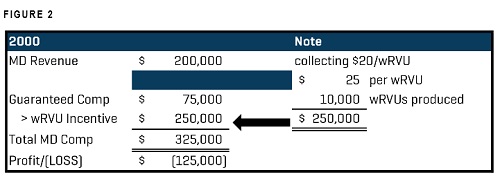

Figure 2

2000s Physician Compensation

Physician plans began compensating, either in whole or part, based on the individual provider’s productivity to stimulate providers with financial upside, should they hit productivity goals. It should be noted that these models generally do not account for revenues collected per wRVU, purely the production side. For instance, in Figure 2, if we pay Dr. X $25/wRVU and we only collect $20/wRVU, we are decidedly underwater from the get-go exclusive of our cost structure within the health system. It is incumbent on the system to tactically manage its revenue cycle to ensure maximum collections of money due the system.

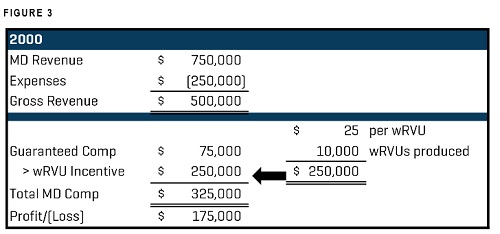

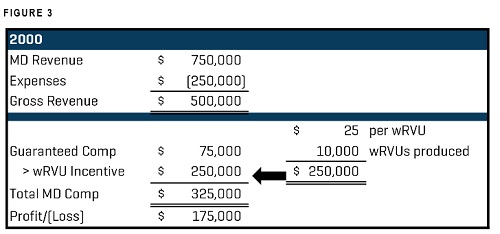

Figure 3

2000s Physician Compensation

In Figure 3, Dr. X is generating $750,000. The cost to run his practice is $250,000. (Exclude accrual accounting from the equation – for example’s sake, this is collected money.) Dr. X is guaranteed a small base ($75,000) and is paid $25/wRVU. Generating 10,000 wRVUs, Dr. X has added another $250,000 to his compensation for total physician compensation of $325,000. Reducing the gross revenue by the provider compensation leaves a profit of $175,000 (most systems “subsidize” employed providers).

Many of these models, in some form or another, exist today, holdovers that are fairly easy to understand and implement. Some private practices have even deployed these models in an attempt to motivate providers and enable them to choose their workload while clearly understanding how that might impact them.

Enter the Value Era

Many health systems and hospitals are contemplating changing their compensation structures, disrupting current paradigms regarding physician pay by embedding components addressing rules from Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) and its associated component pieces of the new Merit Based Incentive Payments System (MIPS) and alternative payment models (APMs) into compensation plan design.

Systems with employed physicians who are not knee-deep in MIPS or APMs begin with one foot in hole. However, forward-thinking systems are beginning to evaluate how to incent physicians, marrying behavior with quality and efficiency as well as production.

As “pay for value” continues to evolve, compensation models must necessarily change to consider the value of care delivery. This creates a fine balance of quality care delivery while understanding that patient volume loads (and compensating for the same) may not soon recede. As these compensation plans evolve, systems must make sure that plans pass fair market value (FMV) review to ensure that the system is not overpaying the provider, which may draw the ire of the federal government.

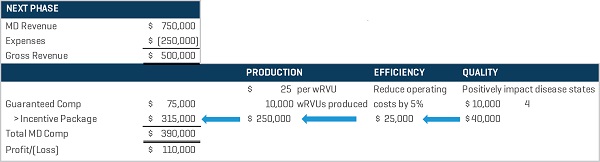

We stipulate that this is not a cut-and-dried situation. This is a hypothetical example delineating the modus of compensation plan design, in broad strokes. Of course, systems will continue to reward for volume but also place a measurable value on quality and efficiency, driving the compensation to realize the value care models. That is, physicians will receive a component piece of their compensation based on care delivery, as evidenced in Figure 4.

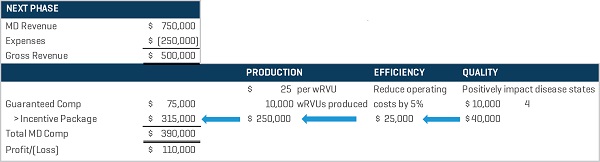

Figure 4

Physician Compensation Incentive Package

As noted, this exercise isn’t intended to indicate how the system is making less money in Figure 4 than Figure 2 (as the data are fictive). It is simply a graphic to offer an examination of how physician compensation is being contemplated and evolving.

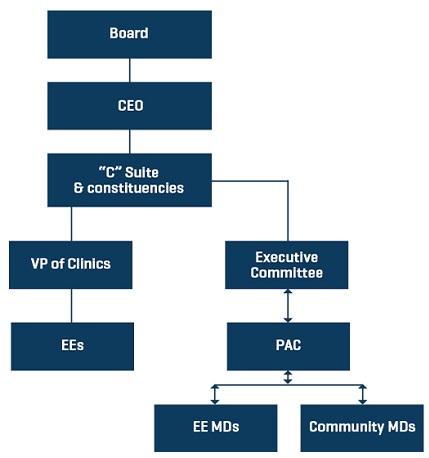

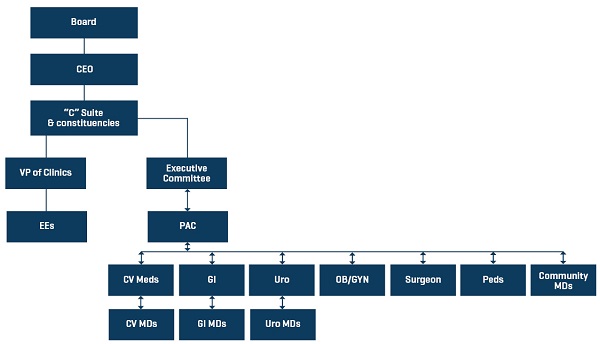

Using our Dr. X example, Hospital Y is deep into MIPS and has determined that its efforts require physician input into quality improvement. In Figure 4, Dr. X retains his nominal base pay and his wRVU production compensation that he had established in Figure 2. Additionally, the system crafted an “efficiency goal” defined as aiding in the reduction of 5% of controllable costs, which would add $25,000 to Dr. X’s compensation if he meets all of the requirements. The system also created a “quality” component of four disease states (ostensibly all valued at $10,000 each) for another $40,000 in potential compensation. These pieces must be measurable and “valued” and cannot be subjective in nature. As an aside, we advocate for a strong physician advisory committee (PAC). A PAC can advise and consent on the development of compensation programs and can assist the health system in determining clinical aspects of care delivery that can be managed and measured to improve quality and value outcomes.

Combining Dr. X’s incentives, we see that he generated $315,000 in incentives to tie in to his base of $75,000. Presuming that his gross revenue (the system is collecting $75/wRVU) is $750,000, removing expenses and MD compensation, the system realizes a $110,000 profit on Dr. X. (Again, as noted in the “2000s” example, most systems subsidize their physician practices/clinics.) The key, too, is ensuring that the “at risk” money (e.g. incentives) is priced at FMV rates and is robust enough to positively impact the physician’s behavior (e.g. production, an eye toward quality and efficiency, etc.)

Realizing the established efficiency and quality goals divined by the health system (with physician executive input) assists the system in moving forward with its goals to meet (or exceed) MIPS goals. The system correlates its efficiency and quality components by specialty to align with MIPS, ensuring that it receives the increased reimbursements two years hence (e.g. 2017 data impacts reimbursements for 2019, 2018 data impacts reimbursements for 2020, and so on).

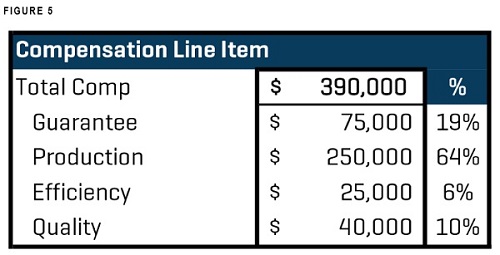

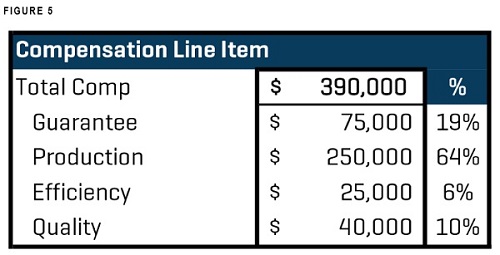

As evidenced in Figure 5, most of Dr. X’s compensation is currently driven by his production. But that may shift as care value is measured, monitored, reported, and reimbursements are more closely aligned with quality of care. The crux of evolving compensation models revolves around the idea that compensation and quality will be woven into a tight tapestry where, at some point, there may exist a shift of a greater level of compensation from production to quality.

Figure 5

Compensation Percentage Allocation

Compensation plans must be carefully built with diligence then tested for FMV considerations. The models within a health system should be as consistent as possible so that there is little variation among system employees. This also renders compensation plans easier to manage.

As with most things in healthcare, there is no one right answer. Even in provider compensation, some things are local.

* To read more about Stout’s experience and how we provided a 15 to 1 return on a client’s initial investment by helping them improve on their revenuecycle, download our case study now.